Details on the objectives for the Employer Company

In our role representing all employers of the Plumbing & Mechanical Services (UK) Industry Pension Scheme, we are seeking your input in setting our objectives.

To do this, our intention is to engage with you in the coming months:

- 1. Firstly, through a survey to understand your priorities.

- 2. Followed by communications and sessions to help you understand the process, and potential cost, of exiting the Scheme, as well as the implications for those preferring to remain in the Scheme longer-term.

We will use this process, particularly your feedback through a survey, to help refine our objectives.

For now, we set our objectives as:

- Security. Ensuring the Scheme meets the members’ benefit requirements.

- Risk. At the minimum risk to the employers (through management and mitigation)

- Release. Whilst achieving release for the employers from their obligations under the Scheme as soon as possible.

Ultimately this is about reducing cash funding risk and reducing the length of time employers are ‘on risk’, whilst delivering the benefits promised. We recognise that different employers will have a different preference for time and risk and our job will be to find a fair balance. This will become clearer once we have numbers to provide you on cost, risk and the 2023 valuation results later in the year.

Meantime, there are a number of ways to deliver these objectives. So far, we have a number of ongoing initiatives:

1. Security and risk objectives. We are liaising with the Trustee as part of the 2023 valuation process which must be agreed between PPEL and Trustee. As part of this, on your behalf, we will ensure that the assumptions used are realistic and up to date; if deficit recovery payments are required, we will ensure they make a meaningful impact on your other objectives like accelerating time to release.

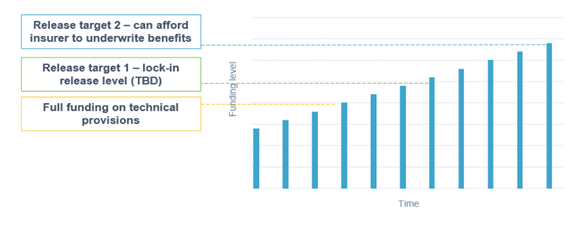

2. Release. As part of the valuation, we will ensure there is a clear journey plan including an investment strategy that aligns with your goals. Through the journey plan we wish to agree with the Trustee a path to reach 2 critical scheme funding levels:

a. Firstly, a level of scheme funding whereby the lock-in rule can be removed or materially eased; and

b. A level of scheme assets where the Trustee and PPEL could get an insurer to underwrite paying all members’ benefits, thereby fully releasing employers from further financial obligations in relation to the Scheme (at that time, achieving all objectives above).

Here’s what this could look like (not yet to scale).

Release. There are two elements to release: statutory release (often called the ‘section 75 debt’) and release under the Scheme’s Lock-in Rule (for more on the latter, see here). We’re working with our legal advisers and the Trustee to bring further clarity to employers around the Lock-in Rule, both when the lock-in rule applies and when it does not. It is our objective that we get to a place where all employers feel sufficiently comfortable that no employers need to remain bound by the Lock-in Rule (see point 1 above) however, we have to work with the Trustee and our advisors to identify when that point is reached. Moreover, we wish to give clarity around this to help feed into your business planning. Our aim is to have this clarity by June 2024 and we’ll be providing you updates throughout the year.